COVID-19 GOVT. RESOURCES

DELAWARE

Delaware is gradually lifting restrictions in rolling reopening of the economy.

Delaware is gradually lifting restrictions in rolling reopening of the economy.

- 6/15 Delaware entered Phase 2 of reopening - Phase 2 Reopening Guidance

- 6/01 Delaware entered Phase 1 of reopening - Phase 1 Reopening Guidance

- 4/01 Restricts Gatherings, Requires Businesses to Strictly Comply with Social Distancing

- 3/23 Declares Public Health Emergency

- 3/22 Issues Statewide Order Closing All Non-Essential Businesses

- 3/22 Issues Stay-at-Home Order for Delawareans

- 3/13 Governor Carney declared a State of Emergency

Business loans & supportFEDERAL

CORONAVIRUS AID, RELIEF AND ECONOMIC SECURITY (CARES) Act

The Coronavirus Aid, Relief, and Economic Security (CARES) Act is the third federal legislation meant to address the COVID-19 crisis. It was signed into law on March 27, 2020. The CARES Act touches on many aspects of the healthcare industry and the overall economy. This memo focuses on the provisions most likely to impact the architecture profession. This is not legal advice; every firm should consult their own counsel for how these policies will impact them specifically. The policies included in the CARES Act build on the first two federal laws passed in response to COVID-19 on March 6 and March 18, 2020. There will likely be additional actions from Congress and the federal agencies to address the health crisis and the economy in the months ahead. A fourth legislative attempt may include infrastructure and other investments. AIA will send additional information as it becomes available.

FAMILIES FIRST CORONAVIRUS RESPONSE ACT (FFCRA)

Congress has passed legislation to respond to the COVID-19 outbreak. Read a memo that describes how these two laws impact business owners. Congress is currently working on a third bill that is meant to be a significant economic stimulus package. AIA CEO/Executive Vice President Robert Ivy, FAIA, and AIA President Jane Frederick, FAIA, sent a letter to Congress imploring its members to provide relief to business owners and employees, and advocating for investment in infrastructure to stimulate economic recovery. Read the media statement AIA National released here.

To help in AIA National’s outreach, take a minute to send this template letter to your member of Congress urging them to provide additional resources to those affected by the virus and for our frontline responders. Please ask them to include significant investment for 21st Century infrastructure and to provide temporary relief measures for business owners. STATE

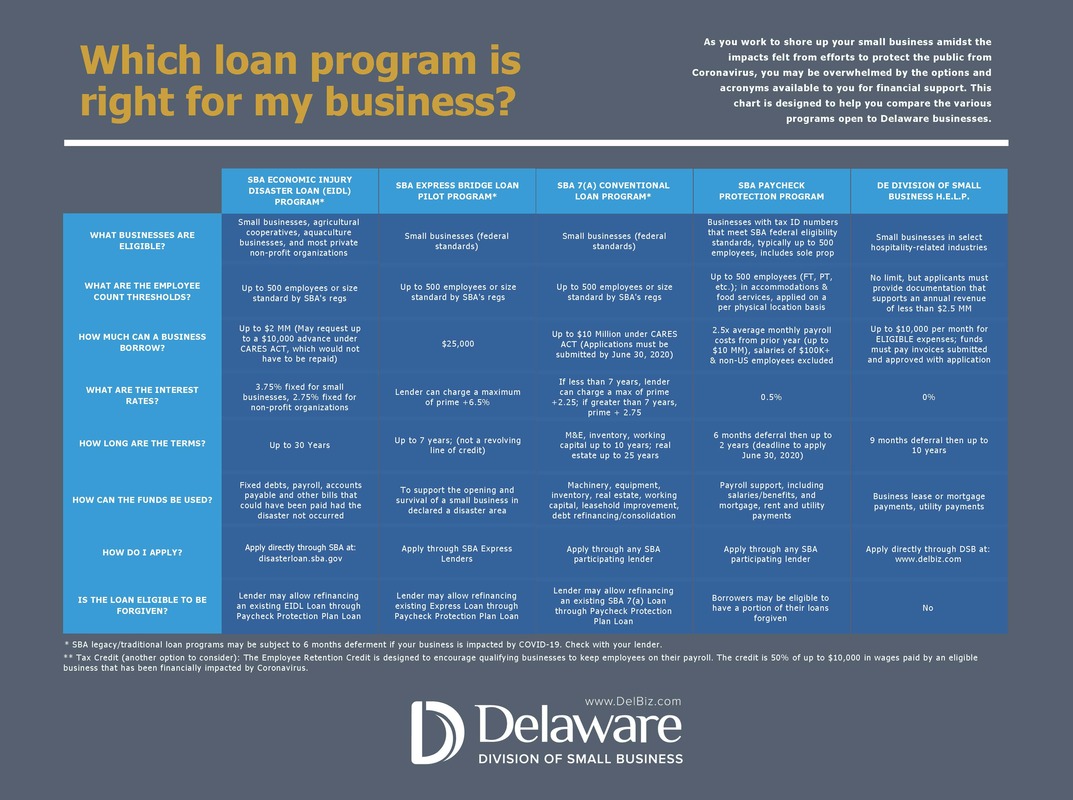

Delaware has been approved for an Economic Injury Disaster Declaration from the U.S. Small Business Administration, which will provide small businesses with working capital loans of up to $2 million that can provide vital economic support to help overcome the temporary loss of revenue they are experiencing. Small businesses and nonprofits can now apply for the loans by clicking here or by contacting the SBA at 1-800-659-2955 to request a paper application. tax filingAs has been reported in IR 2020-58, the Internal Revenue Service has extended the time for filing of tax returns and payment of tax due from April 15, 2020 to July 15, 2020.

On March 12th, the Governor of Delaware issued a State of Emergency Declaration on COVID-19 and it has been subsequently modified. The Dept. of Revenue activated its Continuity of Operations Plan that makes every effort to continue to provide taxpayer assistance and services throughout the State of Emergency in adherence with the Emergency Declaration. DOR continues to process tax returns, filings and refunds requests. As such, DOR strongly encourages all taxpayers to file as soon as possible if you have the necessary information to do so. Pursuant to 30 Del. C. § 1904(b), all final corporate income tax returns are due on the date that the corresponding federal return is due. By operation of law, all Delaware final corporate income tax returns (forms 1100) are now due on July 15, 2020 consistent with the corresponding federal return due date. Continue reading the Delaware Division of Revenue’s (DOR) response to COVID-19. |

AIA urges small business relief, infrastructure investmentAIA’s 95,000 members are committed to protecting the health, safety, and welfare of the public.

The outbreak of COVID-19 and the current health crisis strikes at the very core of this mission. Those personally affected by the virus and our frontline responders need additional resources. As Congress considers additional legislation to stimulate the economy, AIA’s members are calling on policymakers to include significant investments in 21st Century infrastructure and temporary relief measures for business owners. Both will provide much-needed relief in the short-term; reassurance to global markets; and will help prepare this country for the challenges ahead. Learn more... Delaware ResourcesGuidance & Resources for Businesses

|